Author: admin

-

How a Debt Default Could Affect You

As the U.S. approaches the debt default deadline, anxiety is palpable both at home and abroad. Many Americans want to understand the implications of a potential default and how it could affect their daily lives. This article outlines what to expect if the U.S. defaults on its debt and how you can prepare for the…

-

8 Legal Ways to Get Emergency Cash Quickly

In the United States, a staggering 44% of Americans are unable to cover a $1,000 emergency expense. If you find yourself in this situation, it can be disheartening and stressful. Fortunately, there are several legal ways to access emergency cash quickly. This guide will explore effective methods to help you navigate financial challenges without falling…

-

Five Common Types of Installment Loans

Installment loans are a popular borrowing option for many individuals, allowing them to access funds with the flexibility of repaying in scheduled payments. Each installment consists of both principal and interest, making budgeting easier for borrowers. In this article, we’ll explore five common types of installment loans: personal, mortgage, auto, student, and buy now, pay…

-

Understanding Payday Loan Interest Rates and Fees: What You Need to Know

Payday loans are marketed as quick financial fixes that can help you bridge the gap between paychecks. While they may seem like a convenient solution for unexpected expenses, the high interest rates and fees associated with these loans can lead to a cycle of debt that is difficult to escape. In this guide, we’ll explore…

-

A Comprehensive Guide to Emergency Installment Loans

In today’s world, unexpected expenses can arise at any moment, leaving you in a tight financial situation. Emergency installment loans can provide a crucial lifeline for those facing sudden financial challenges, whether due to medical bills, car repairs, or other unforeseen costs. Even if you have bad credit, these loans can help you navigate your…

-

The Best Short-Term Loans for Bad Credit: A Brief Guide

Are you facing a financial crunch but struggling to secure a traditional loan due to bad credit? Short-term loans could be the solution you need. These loans are generally easier to obtain for individuals with poor credit histories, and since they are repaid quickly, they can also help improve your credit score over time. With…

-

What Is a Personal Loan Installment & How to Get One?

Personal loans can be a practical solution for accessing funds quickly during financial emergencies or when planning significant expenses. Among the various repayment methods available, personal loan installments are a popular choice. This article will explore what a personal loan installment is, its benefits, and how to obtain one to address your financial needs effectively.…

-

Frugal Ways to File Your Taxes

Finding the Cheapest Way to File Taxes Tax season is upon us, and that means it’s time for number crunching and filing your taxes! While some may dread the process, others may find excitement in the prospect of a refund. However, the time and money spent on filing can be daunting. Fortunately, there are several…

-

Corporate Entrepreneurship: Meaning, Importance, Types, and Models

Imagine a scenario where your company’s current products aren’t the future success story, but instead, it lies in unexplored ideas and entrepreneurial spirit within the organization. Amid global uncertainties and constant change, corporate entrepreneurship offers a platform to rebuild, invigorate, and sustain your business. Are you ready to explore how this revolutionary approach can transform…

-

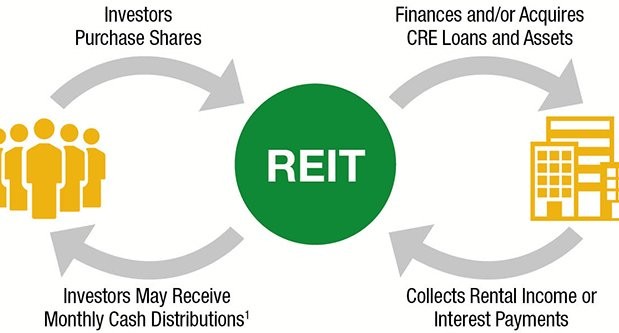

Real Estate Investment Trust (REIT): Meaning, Types & Limitations

Are you considering investing in a portfolio of high-quality commercial properties without the need for substantial capital or the hassle of property management? Real Estate Investment Trusts (REITs) provide an accessible way to invest in the booming real estate market, making wealth growth easier than ever. Let’s explore the key aspects of REITs in this…